If you work online or want to work online from home, one of the priorities is understanding how to get paid online. Should you use PayPal or Payoneer?

The table below provides a quick comparison of the two services.

| Features | PayPal | Payoneer |

| Set up a virtual bank account | No | Yes |

| (Almost) worldwide availability | No | Yes |

| Payments can be collected via your website. | Yes | No |

| Create a Mastercard | Yes | Yes |

| Tougher policies | No | Yes |

| Accepting company and or organization payments | Yes | Yes |

This article will compare the two services to assist readers in deciding which service to use to earn money on the internet.

One way to get paid online is to connect your bank account to the business, which allows them to deposit funds directly into your account.

The second and more common approach is to use a financial service to handle and protect your online payments for all companies. Payoneer.com and PayPal.com are the two websites we’ll talk about this time (these two services will help you get paid on the internet).

So, let’s go through six things to think about while deciding between PayPal and Payoneer.

1. Using the website to accept payments

If you want to purchase from SheyiDairo’s eCommerce course, you must do so via the website. You will notice that you can pay with PayPal when completing your order, allowing you to get paid directly from your website.

Payoneer, unlike PayPal, does not allow you to receive payments from your website.

2. Receipt of payments from businesses

If you go to Udemy, a platform that lets you build, purchase, and sell online courses, you’ll notice that it can accept payments through PayPal or Payoneer. If this feature appeals to you, you won’t be disappointed regardless of the service you choose.

3. Open a virtual bank account

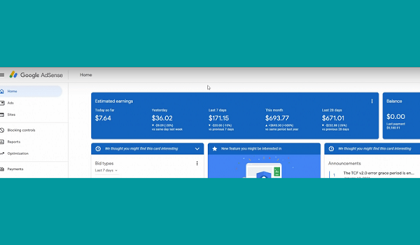

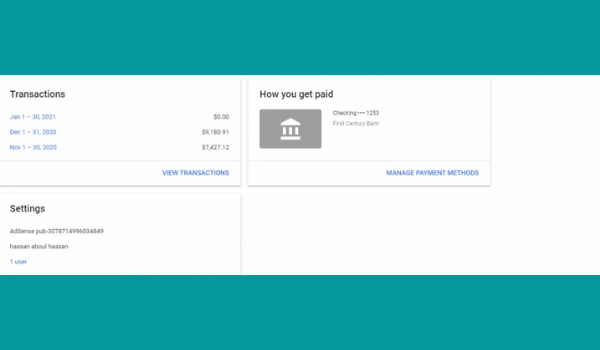

If you’re unfamiliar, Google Adsense is a Google service that allows you to monetize your website with advertisements and earn money online.

When you go into the “Payments” section of the Google Adsense dashboard, you’ll see that you can add a bank account generated with Payoneer when managing your payment methods.

Payoneer allows you to open virtual bank accounts outside of your country, from which you can conveniently withdraw funds to a bank account in your home country.

You can use PayPal to get paid online by connecting your bank account, but you can’t build new virtual bank accounts.

4- Making your own Mastercard.

You can make Mastercards and withdraw money anywhere in the world using PayPal or Payoneer.

5- Accessibility

Payoneer is almost universally accessible, although PayPal is only available in a limited number of countries. If you live in a country where PayPal is not accessible, you will have no choice but to use Payoneer to receive online payments.

6- Policies

Payoneer has stricter rules, such as not allowing money transfers for giveaways, while PayPal is less strict and does allow money transfers for giveaways.

You are now eligible for receiving payment.

As you can see, both financial services have benefits, and it’s easy to see how online business owners and people looking to get paid online, in general, can benefit from using at least one, if not both, of these services.

I hope this article helped you decide between PayPal and Payoneer. Do you have any further questions? Please leave your response in the comments section!